Some reflections on developing India’s Blue Economy

Promoting marine renewable energy (MRE) and implementation of Emission Control Areas (ECAs) are some of the measures which can be adopted by countries in the Indian Ocean Region and the South China Sea to promote maritime sustainability. Financing sustainable maritime development is also critical for implementing Blue Economy and ‘debt for nature swaps’ provide an innovative financing mechanism to fund sustainable development in the maritime domain.

By Cdr Kapil Narula (Retd.)

July 5, 2022

Introduction

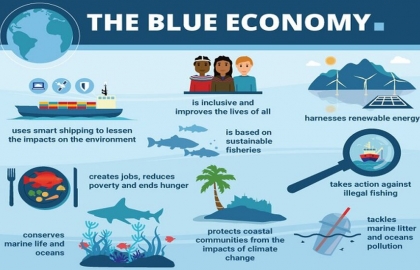

Blue Economy has become a buzzword for the 21st century and is touted as a magic potion which will provide an alternate growth model to the world. Yes, Blue Economy has the potential to deliver on these promises, if and only if certain key principles are respected. This paper intends to demystify the myth that all maritime activities proposed as a part of Blue Economy are sustainable. Thereafter, it discusses sustainability in two important maritime sectors, namely offshore energy (in the context of India) and shipping, and examines an innovative model for financing sustainable maritime development. These approaches can be widely adopted in the Indian Ocean Region (IOR) and the South China Sea (SCS).

Assessing the sustainability of maritime activities

The term sustainability has many interpretations. A clear and objective definition is provided by “The Natural Step” which outlines four sustainability principles.[i] According to them, in a sustainable society, nature is not subject to systematically increasing…

Blue Economy has become a buzzword for the 21st century and is touted as a magic potion which will provide an alternate growth model to the world. Yes, Blue Economy has the potential to deliver on these promises, if and only if certain key principles are respected. This paper intends to demystify the myth that all maritime activities proposed as a part of Blue Economy are sustainable. Thereafter, it discusses sustainability in two important maritime sectors, namely offshore energy (in the context of India) and shipping, and examines an innovative model for financing sustainable maritime development. These approaches can be widely adopted in the Indian Ocean Region (IOR) and the South China Sea (SCS).

Assessing the sustainability of maritime activities

The term sustainability has many interpretations. A clear and objective definition is provided by “The Natural Step” which outlines four sustainability principles.[i] According to them, in a sustainable society, nature is not subject to systematically increasing…

- … concentrations of substances from the earth’s crust (such as fossil fuels, heavy metals and minerals)

- … concentrations of substances produced by society (such as non-degradable waste, CO2 emissions, etc.)

- … degradation by physical means (such as deforestation, draining of groundwater tables).

- And in that society there are no structural obstacles to people’s health, influence, competence, impartiality and meaning.

When the first principle is applied to the maritime domain, it implies that offshore extraction of fossil fuels (oil and gas), other non-renewable marine resources and seabed mineral resources is unsustainable. According to the second principle, “shipping” which produces increasing quantities of greenhouse gases (GHG), air pollutants and marine pollution (due to ballast water contamination, oil leakages etc.), is unsustainable in its current form. In accordance with the third principle, bottom trawling which leads to a large bycatch, degrades the seafloor (seamounts and deep sea corals) is unsustainable. Similarly, any coastal development activities which lead to destruction of mangroves and coastal habitat are also unsustainable. According to the fourth principle, actions which are detrimental to human health (e.g. increase in use of micro-plastic which eventually reaches the marine food chain); measures which limit access to public goods offered by the oceans; policies which leads to privatisation of profits and socialisation of losses and increases the gap between rich and the poor (and between countries) would also be classified as unsustainable.

Strong and weak sustainability

Noting that many activities, in their current form, violate the principles of sustainability, it is important to understand the difference between strong and weak sustainability. Weak sustainability implies complete substitutability between five different types of capital: manufactured capital (material infrastructure, machines); human capital (knowledge, skills); social capital (business, schools); natural capital (stock or flow of energy and material) and; financial capital (currency, shares). It is also important to note that financial capital has no real value in itself, but only enables trading of other forms of capital. On the other hand, strong sustainability implies that there is no substitutability between different forms of capital and all forms are considered complementary. Hence, natural capital cannot be destroyed to increase manufactured or financial capital.

Currently, the most widely known model of sustainable development is where sustainability is considered as an intersection of social, economic and environmental dimensions. Coupled with the weak sustainability approach, this model allows any of the three dimensions (often economic) to grow in an unconstrained manner at the expense of the other dimensions, as different forms of capital are considered substitutable. Instead, a nested model, where ‘manufactured’ and ‘financial’ capital is a subset of ‘social’ and ‘human’ capital and where all these are nested in ‘natural capital’, is more realistic. This model together with the concept of strong sustainability represents that ‘natural capital’ sustains all other forms of capital and hence its preservation is a necessary condition for growth of other forms of capital. However, in actual practice, maritime activities lie somewhere on the continuum between very weak and moderately strong sustainability.

Promoting marine renewable energy in India over offshore hydrocarbons

About 30-35% of the global oil and gas production is from offshore areas.[ii] This can be replaced by marine renewable energy (MRE), which is estimated to be the second largest source of energy on the earth (after solar energy). India's potential for offshore wind is estimated to be at least 100 GW and there are plans to install 5,000 megawatts of offshore wind capacity by 2022; and 30,000 megawatts by 2030.[iii]

The first step in establishing offshore wind farms in India commenced with the Facilitating Offshore Wind in India (FOWIND) project which was a four-year project to develop a roadmap for offshore wind. It commenced in 2014 and received a funding of € 4 million from the European Union (EU). The project included resource mapping, techno-commercial studies, policy guidance, capacity building measures and sharing of experience for lowering technical barriers and financial risks.

This was followed by the First Offshore Windfarm Project in India (FOWPI), with a funding of €1.8 million from the EU.[iv] This commenced in 2016 and provided technical assistance in preliminary implementation of the first off-shore wind farm project in India. A 70 sq. km. seabed area, 25 km off the Jafrabad port, Gujarat was identified for installing 200 MW wind farm at a depth of 14-18 mts. Activities under the scope of the project included specific technical studies including coastal surveys, wind farm layout and conceptual design, energy yield estimates, financial modelling, cost-benefit analysis, environmental impact assessment, preliminary foundation design, electrical transmission layouts, permits and procedures, building of knowledge bank and capacity building. The project is expected to be operational by 2022 and is expected to have a life of 20 years.[v]

India has also experimented with Ocean Thermal Energy Conversion (OTEC) technologies and it is estimated to have a potential of 180 GW.[vi] It is an ideal solution for islands with the ability to integrate low temperature thermal desalination (LTTD) plant for fresh water. Tidal (range and current), wave, current and technologies based on salinity gradient are other sources of MRE. The economic potential of tidal power in India is estimated as 8-9 GW, of which about 7 GW in the Gulf of Cambay, around 1.2 GW in the Gulf of Kachchh and the remaining in the Sundarbans.[vii]

The major advantage of MRE include a high capacity factor as compared to other renewable energy sources such as wind and solar energy. However, the high capital investment for MRE, low technology readiness levels (TRLs) for some technologies, high maintenance, and falling levelized costs from solar PV is detrimental to the large scale deployment of MRE. Nevertheless, there are niche geographical areas such as remote islands, where MRE technologies should be preferred to promote Blue Economy.

Sustainable shipping

Sustainable shipping is a mainstay of the Blue Economy. As international shipping does not fall under the preview of any one country, it has traditionally been excluded from national accounting mechanisms and global climate agreements. However, the International Maritime Organisation (IMO) is providing a leadership role to improve shipping energy efficiency and to decarbonise shipping.[viii] It has also taken measures to lower sulphur emissions from shipping which will result in reducing the global warming impact of black carbon and other short lived pollutants emitted by ships. The shipping industry uses one of the highest polluting fuels (bunker fuel). The limits for use of low sulphur fuels in shipping were gradually tightened from 4.50% m/m (before 2012) to 3.5% m/m (2012-2019). Since 01 January 2020, sulphur limits in fuels have been further revised from 3.5% m/m to 0.50% m/m.

In order to lower local air pollution from emission of oxides of sulphur (SOx) and Particulate Matter (PM) in port cities, six Emission Control Areas (ECAs) around Europe and North America were defined in Annex VI to the MARPOL. For ships operating in these ECAs, more stringent limits for use of sulphur were defined. These limits were 1.0% m/m (2010-2014) which were subsequently lowered to 0.1% m/m (from 01 Jan 2015).

In order to increase shipping sustainability, China implemented Emission Control Zones (ECZs) in the territorial waters (12 nautical miles off the coastline) in the Pearl River Delta (PRD), the Yangtze River Delta (YRD) and the Bohai Bay. Commencing January 01, 2019, the sulphur requirement was reduced to 0.5% m/m for all ships operating within the (ECZs). Since January 01, 2020, vessels operating in the inland ECAs (Yangtze and Xijiang River) are also obliged to use fuel with a sulphur content not exceeding 0.1% and the same will apply within the Hainan coastal ECA from January 01, 2022.[ix] Authorities are also considering implementing a 0.1% sulphur cap in the coastal ECA from January 01, 2025.

Taking a cue from China, a new ECA (known as Control Zones) has been declared in selected ports of South Korea (Incheon, Pyeongtaek - Dangjin, Yeosu - Gwangyang, Busan, and Ulsan area) where it is mandatory for ships to use fuel with less than 0.1% sulphur content during berthing or anchoring, commencing September 01, 2020. These regulations will apply to all ships while navigating within the Control Zones from January 01, 2022. In order to implement these measures, the annual budget for controlling port particulate pollution has also been quadrupled to US$ 100 million, from the current level of US$ 26 million.[x]

Hong Kong is also considering a similar ECA but it has not yet been notified.[xi] These ECAs can be replicated and expanded in various city port cities in countries of the IOR and the SCS and is a percussor to further desulfurization of bunker fuels in domestic and international shipping.

Financing sustainable maritime development

A major limitation in developing the Blue Economy is financing. A successful financing model is the “debt for nature swap” which can enable flow of funds into ‘climate adaptation’ activities in the IOR and in the SCS.As a successful example, the Seychelles government in 2018, with support from The Nature Conservancy (TNC), the Global Environment Facility (GEF), the United Nations Development Program (UNDP), and some private investors, concluded a plan for swapping its sovereign debt for protecting its oceanic spaces.[xii]

As part of the plan, the consortium purchased $27 million of the country’s debt, in exchange to secure about 81,000 square miles around the Aldabra Atoll, which is a UNESCO World Heritage Site, from fishing, oil exploration, and commercial development. The payments from the creditors will be transferred to a newly-created ‘Seychelles Conservation and Climate Adaptation Trust’. This money will then be used to repay the initial capital raised and also fund marine conversation plans such as coral reef and mangrove restoration, improving sustainable tourism, and other conservation activities. This will also enable funding of other activities for sustainable maritime development such as protection of marine parks, fisheries management, biodiversity conservation, and activities to build climate resilience.[xiii]

Conclusion

An objective assessment of various maritime activities using the four principles of sustainability reveals that most of the current maritime activities are unsustainable. A nested model of sustainable development and a differentiation between strong and weak sustainability is essential to have a clear understanding of which activities should be included as a part of the Blue Economy. Promoting MRE and implementation of ECAs are some of the measures which can be adopted by countries in the IOR and SCS to promote maritime sustainability. Financing sustainable maritime development is also critical for implementing Blue Economy and ‘debt for nature swaps’ provide an innovative financing mechanism to fund sustainable development in the maritime domain.

Cdr (Dr.) Kapil Narula (Retd.), is an energy and sustainability professional. His career goal is “to provide a leadership role to the world, onto a path of sustainable development”. Kapil served for more than 20 years in the Indian Navy (IN) and worked onboard ships, as a faculty, and as a researcher. He has a master’s degree in electrical engineering and a PhD in development economics. Kapil currently works as a Senior Researcher at the University of Geneva, Switzerland and an Honorary Research Fellow at the National Maritime Foundation, New Delhi, India. Kapil envisioned, advocated and formulated an energy policy for the IN and was instrumental in developing the ‘Indian Navy Environment Conservation Roadmap’ (INECR).

Notes

[i] The Natural Step. 2020. "Our Approach: The Natural Step Framework". https://thenaturalstep.org/approach.

[ii] Narula, K., 2019. "The Maritime Dimension Of Sustainable Energy Security". Singapore: Springer.

[iii] COWI. 2020. "India's First Offshore Wind Farm - Harnessing The Potential Of Gujarati Coastline". https://www.cowi.com/solutions/energy/indias-first-offshore-wind-farm.

[iv] GWEC. 2016. "Facilitating Offshore Wind In India". http://www.gwec.net/wp-content/uploads/2014/03/FOWIND_leaflet_105x210_web.pdf.

[v] Vølund, P. 2017. "First Offshore Windfarm Project In India (FOWPI) With EU-Backing". NIWE. https://niwe.res.in/assets/Docu/Mr.Per_Volund-FOWPI_Project&European_OWF_Exp_02Jun2017.pdf.

[vi] Offshore Energy. 2019. "New Opportunities For OTEC In India - Offshore Energy". https://www.offshore-energy.biz/new-opportunities-for-otec-in-india.

[vii] EAI. 2017. "Ocean Energy In India". http://www.eai.in/ref/ae/oce/oce.html.

[viii] Narula, K. 2014. "Emerging Trends In The Shipping Industry –Transitioning Towards Sustainability". Maritime Affairs: Journal Of The National Maritime Foundation Of India 10 (1): 113-138. doi:10.1080/09733159.2014.928473.

[ix] DNV GL. 2020. "Global Sulphur Cap 2020 - DNV GL". https://www.dnvgl.com/maritime/global-sulphur-cap/index.html.

[x] Finamore, B. 2019. "South Korea Establishes An Emission Control Area For Ships". NRDC. https://www.nrdc.org/experts/barbara-finamore/south-korea-establishes-emission-control-area-ships.

[xi] Damgaard, J., 2020. "Low Sulphur Regulations After 1 January 2020 – Britannia". Britannia P&I. https://britanniapandi.com/blog/2020/01/01/low-sulphur-regulations-after-1-january-2020/.

[xii] Dahir, A., 2018. "Seychelles Is Swapping Its Sovereign Debt With A Plan To Protect Its Ocean". Quartz Africa. https://qz.com/africa/1216791/seychelles-swaps-debt-for-marine-conservation-climate-change/.

[xiii] Bhandari, P., 2020. "Can Swapping Debt For Climate Action Help With Pandemic Recovery?". ADB. https://blogs.adb.org/blog/can-swapping-debt-climate-action-help-pandemic-

Topics:Economy

Share:

Comments (0)

Same category

© 2016 Maritime Issues